Accacia: Decarbonizing Real Estate with AI and Big Data

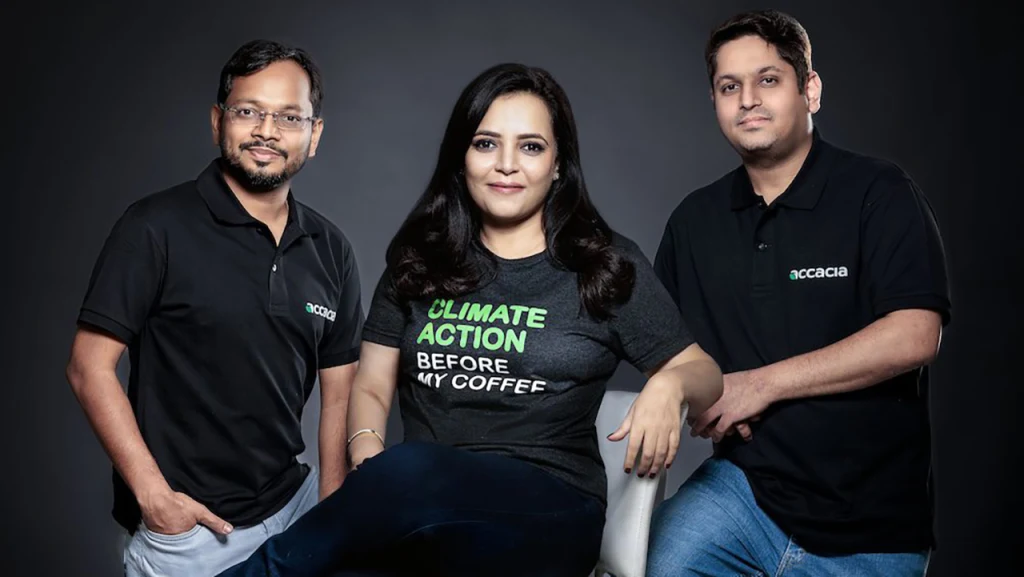

Accacia, a rising star in the climate tech landscape, is tackling the challenge of decarbonization head-on. Founded in 2022 by a trio of INSEAD alumni – Annu Talreja, Piyush Chitkara, and Jagmohan Garg – this innovative platform empowers real estate and infrastructure companies to manage and minimize their carbon footprint.

Empowering Decarbonization Strategies with AI-Powered Solutions

Accacia utilizes an AI-enabled Software-as-a-Service (SaaS) platform to equip asset managers, owners, and developers with a robust toolkit. This platform allows for:

- Precise Emissions Tracking: Accurately measuring and monitoring carbon emissions across assets becomes a seamless process.

- Strategic Decarbonization Plans: Armed with comprehensive data, companies can chart personalized decarbonization paths.

Securing $6.5 Million to Scale Globally

Accacia recently announced the successful completion of a $6.5 million (approximately Rs 54 crore) pre-Series A funding round. Illuminate Financial, a venture capital firm focused on fintech solutions for the financial services industry, spearheaded the round. Existing investors Accel and B Capital, along with Southeast Asia-based AC Ventures, also participated.

Addressing Regulatory Mandates and Market Demands

Annu Talreja, Founder and CEO of Accacia, highlights the timely arrival of this funding: “This investment comes at a critical moment. Regulatory bodies like the Securities & Exchange Commission (SEC) and the Singapore Exchange (SGX) are demanding stricter carbon emissions reporting. Here, Accacia steps in, offering real-time climate risk data solutions. We’ve already deployed our platform across over 25 million square feet of real estate, and this funding allows us to leverage this momentum and scale globally.”

Seamless Integration for Enhanced Efficiency

Accacia’s platform is designed for seamless integration with existing systems like Property Management, Energy Management, and Procurement platforms. This automation of data capture and real-time tracking positions Accacia as a cost-effective and rapid solution for real estate companies aiming for net zero emissions.

Going Beyond Measurement: AI-Driven Recommendations

Accacia goes beyond mere measurement. It utilizes an AI-driven recommendation engine, suggesting practical and effective decarbonization strategies focused on both individual assets and entire portfolios.

Addressing a Global Challenge

The growing urgency for decarbonization is amplified by new regulations from bodies like the SEC and SGX. With over 25 million square feet of real estate already employing Accacia’s technology, the company is well-positioned to capitalize on these new demands and expand its global operations.

Fueling Growth and Innovation

The influx of capital will be strategically deployed to enhance Accacia’s technological offerings and fuel its global expansion. The real estate sector, responsible for nearly 40% of global greenhouse gas emissions, represents a significant opportunity and challenge when it comes to decarbonization efforts.

Partnering for a Sustainable Future

Rezso Szabo, Partner at Illuminate Financial, recognizes the significance of Accacia’s solutions: “Measuring and managing climate risks is crucial for large financial institutions, especially in real estate, a major and highly impacted asset class. Given Annu’s experience in the real estate industry, we believe Accacia is ideally positioned to lead the global real estate decarbonization market. We are thrilled to partner with the Accacia team.”

Helen Wong, Managing Partner at AC Ventures, echoes this sentiment: “While real estate is a major contributor to GHG emissions, its complex value chain (construction vs operations) and diverse asset uses create significant challenges for decarbonization. Our commitment to climate action led us to believe that the sector needed a custom solution. Accacia’s tailored platform impressed us, and we’re excited to see them continue building a more sustainable future for real estate.”

Team Accacia

Team Accacia